Real-Time Analytics For Insurance

Lack of communication between the underwriters and insurance agents makes it quite impossible to collect, share and analyze the data. Due to unavailability of proper data analytics techniques, data obtained from the application just sits idle at a storage system, costing huge amount of loss in sales.

With new changing trends, insurance companies are now realizing the essence of data analytics in the achieving the following goals:

- Being more customer-centric,

- Preventing and reducing possible frauds

- Deciding on-pricing premiums,

- Self-servicing of policies, etc.

Summarizing the Data Analytics Scenario in Insurance Sector

As per a recent analysis by Willis Towers Watson, about 66% of insurance companies give credit to predictive analysis for reducing underwriting expenses and issues, while 60% recognize the importance of data in increasing sales and profits. Usage of data analytics has helped in the surplus increase of policies from 2k in 2011 to more than 6k in 2014. Big Data has, and is still contributing more than 45% in aspects like better management decisions, understanding customer needs, pricing and risk selection, product development, etc.

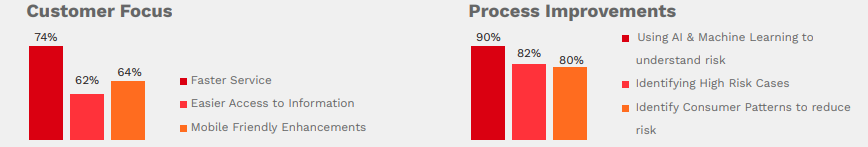

Chart below summarizes the usage of data analytics in various areas like customer focus, claims management and process improvements.

How BIRD helps the Insurance Sector

Forecasting Claims

- Forecast number of claims for the next 6 to 12 months.

- Get forecast with respect to various categories, sub-categories, etc.

- Use forecasting for better planning of budgets.

- Identify root cause analysis before forecasting claims.

Fraud Detection

- Detect outliers and fraudulent patterns in claims data, through advanced deep learning and text analysis.

- Delve deeper into the outliers by flagging claims.

- Identify patterns to proactively improve processes

Automated Claim Processing

- Use advanced ML techniques to automatically approve or reject claims.

- Reduce number of man-hours in manual processing of claims.

- Use advanced machine learning models to detect more patterns in claims.

- Train and develop models to achieve efficient reduction of claim rejections.

Customer Segmentation

- Use various clustering models to segregate customer data.

- Proactively monitor performance of agents (in terms of SLAs) by analyzing patterns in each of the customer segments.

- Classify customer data by different categories to focus on more opportunities.

Key Benefits with BIRD

Eliminate Data Silos

Use our connectors to integrate your data at one place.

Self-Service

Avail real time analytics with advanced visualizations.

Modern ELT

Use high performance and extensive data preparation features.

Predictive Insights

Use multiple ML models for forecasting, prediction, and text analytics.

Universal Data Model

Create single data model with multiple fact tables.

Big Data Architecture

Event driven architecture to ingest and process real time data.

Augmented Analytics through BIRD

Use our augmented analytics methodology to leverage customer data from various IOT wearables, and thus predict and calculate risks through artificial intelligence.

Get into Action from Insights

The powerful and collaborative on-the go storyboards ensure that the insights are displayed seamlessly, regardless of user location, and more importantly, on time to take key business decisions.

BIRD has been certified for the internationally recognized ISO 27001:2013 standards that endorse the company’s commitment to high standards and security controls. We are also HIPAA and GDPR compliant and currently in the process of getting FedRAMP certification.

Try BIRD to reveal insights on

your own data, with a free POC now!

Contact: [email protected]